The name floor trader pivots comes from a time before online trading where floor trader s needed an easy formula to determine whether a price was relatively cheap or expensive before.

Floor pivot point formula.

Pivot points are based on a simple calculation and while they work for some traders others may not find them useful.

The most popular method for calculating floor trader pivots is the original formula.

A pivot point is a technical analysis indicator used to determine the overall trend of the market over different time frames.

Since forex is a 24 hour market most forex traders use the new york closing time of 5 00pm est as the previous day s close.

Pivot point formula one of the best thing about the pivot point is the ease of their calculation and after that you will get 3 point of resistance and 3 point of support for the underlying stocks assets to calculate pivot point yourself you pivot point day s high price day s close day s close 3 support 1 pivot point 2 day s high.

The formula uses the previous day s high low and close to calculate the central pivot neutral area for the market.

Pivot points are also know as floor trader pivots or pivots or floor pivots or session pivots.

The floor pivot points are the most basic and popular type of pivots.

Generally as we enter each trading day we regard this level as our balance point between bullish and bearish forces.

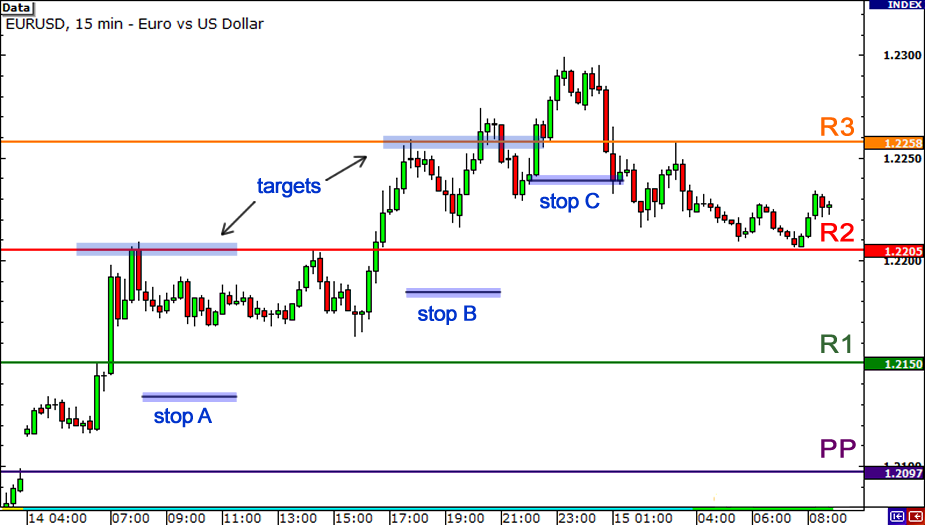

The off floor active trader is able to use these same values as an aid in determining appropriate areas for trade entry stop placement and exits.

The principle level of reference is the daily pivot.

There is no assurance the price will stop at reverse at or even reach the.

Once pivot points are set they do not change and remain in play throughout the day.

These are the places where traders expect support and resistance to occur in the market and as such are used as entry and exit points for trades.

Pivot points for 1 5 10 and 15 minute charts use the prior day s high low and close.

The pivot point and associated support and resistance levels are calculated by using the last trading session s open high low and close.

The pivot points calculation for trading is more useful when you pick time frames that have the highest volume and most liquidity.

Depending on the type of pivot formula used you can generally generate and use up to 9 levels.

/PivotPoint-5c549c1246e0fb000164d06d.png)

/dotdash_Final_Using_Pivot_Points_for_Predictions_Feb_2020-01-b3d14a9e8e864875aa404a7664fbb23b.jpg)

:max_bytes(150000):strip_icc()/PricePivotsCircleBigProfits2-177bf6080df249f9ac64de40a6a863d4.png)